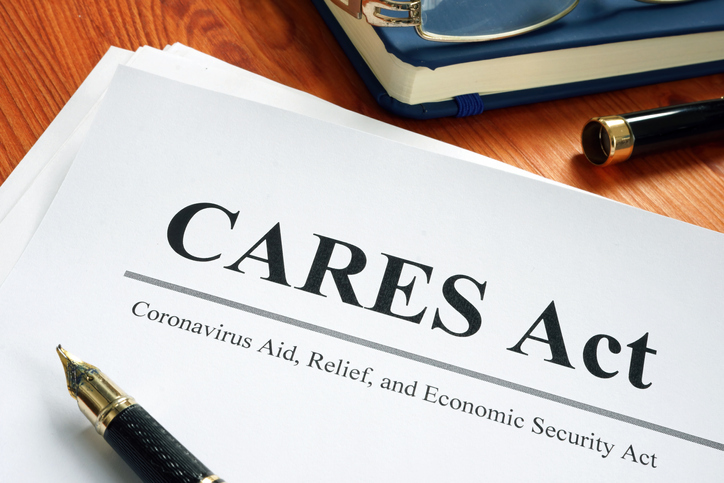

CARES Act Update: Retirement Plan Distribution Relief

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was enacted on March 27, 2020. Since then, the IRS has issued several Notices with additional information and guidance related to the CARES Act including the tax rules applicable to employer-sponsored qualified retirement plans and individual retirement accounts (IRAs). Individuals and plan sponsors should be aware of these key provisions. Here are the highlights...

Topics: Accounting Hot Topics, COVID-19 Updates

The IRS has revised Form 941 beginning with the filing of the 2nd Quarter of 2020, in conjunction with reporting the various Covid-19 tax credits and deductions. Please use this as a reference to assist in reviewing the information that has been filed on Form 941 by your company or your payroll provider.

Topics: Accounting Hot Topics, COVID-19 Updates

SBA Releases New PPP Loan Forgiveness Forms and Instructions

This past week, new PPP forgiveness applications were released by the SBA to simplify the process and mirror the language of the PPP Flexibility Act that was signed into law earlier this month. We're here to clarify some of the changes to the application and shed light on a newly updated interim final rule.

Topics: COVID-19 Updates

The Small Business Administration (SBA) has released a Loan Forgiveness Application for the Paycheck Protection Program (PPP), which was created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The application and its instructions provide step-by-step guidance on calculating a borrower's PPP loan forgiveness amount. The application is much anticipated and helps clarify some of the questions we referred to in our previously published Top Ten Questions About the PPP blog -- but not all. The SBA and the U.S. Treasury have indicated they will continue to release guidance on the forgiveness calculation.

Topics: Tax Topics, COVID-19 Updates

On May 21, 2020, Governor Whitmer announced Executive Order 2020-97 (amending Executive Order 2020-91) which indicates that all businesses or operations that are permitted to require their employees to leave the homes or residences for work under Executive Order 2020-92 (since amended to Executive Order 2020-96 and extended through June 12, 2020 under EO 2020-100) and any order that follows it, must, at a minimum:

Topics: Tax Topics, COVID-19 Updates

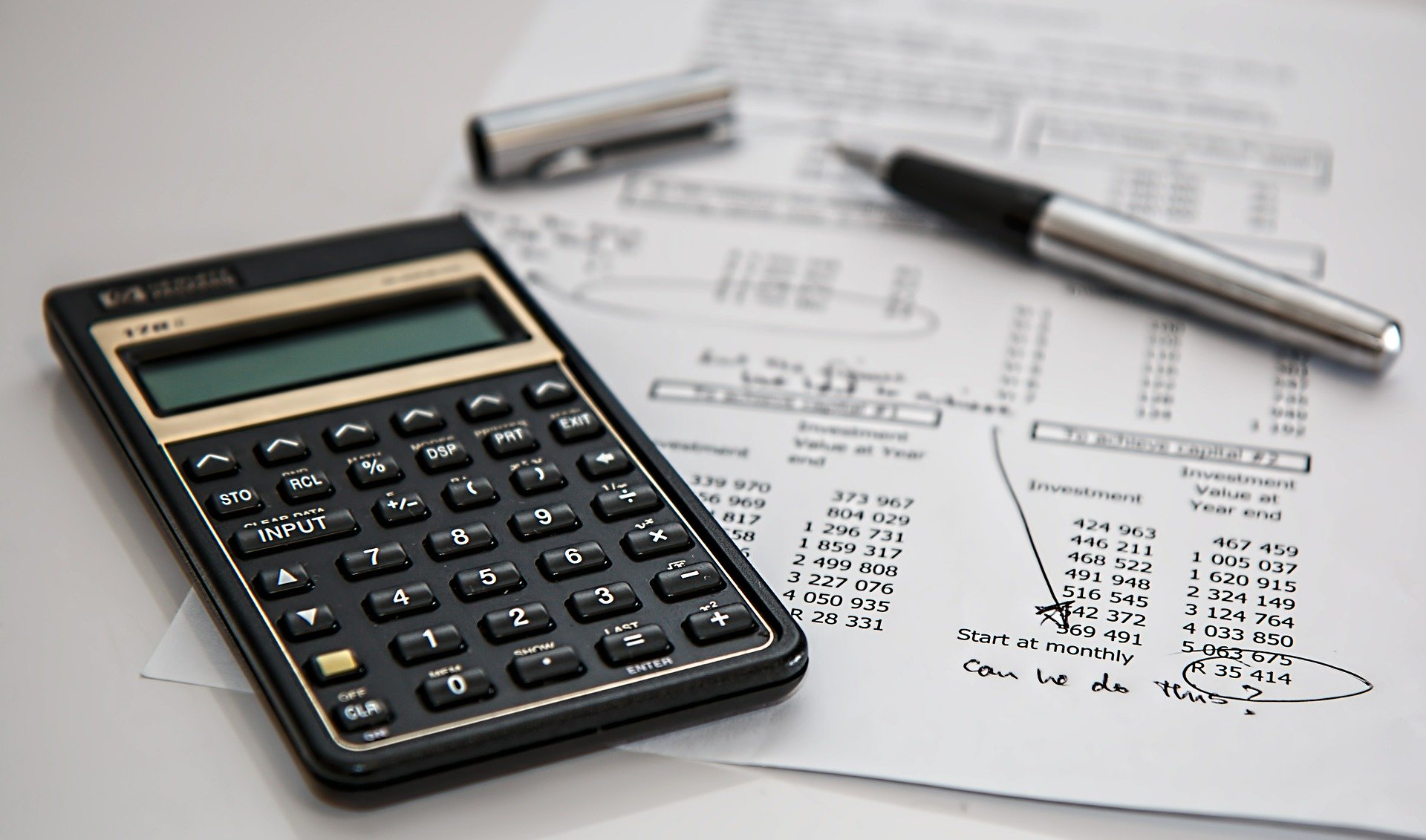

The COVID-19 pandemic has had far-reaching consequences across the entire business world and one of the most hard-hitting effects has been the reduction of cash flow throughout nearly all business lines. Invoices are not getting paid on time, monthly bills are accumulating, and for some businesses, (like restaurants and theaters) activity and cash inflow may be completely stopped. To provide some relief to businesses affected by the coronavirus, Congress recently passed the CARES Act which offers the possibility of a one-time infusion of cash in the form of tax refunds.

Topics: Tax Topics, COVID-19 Updates

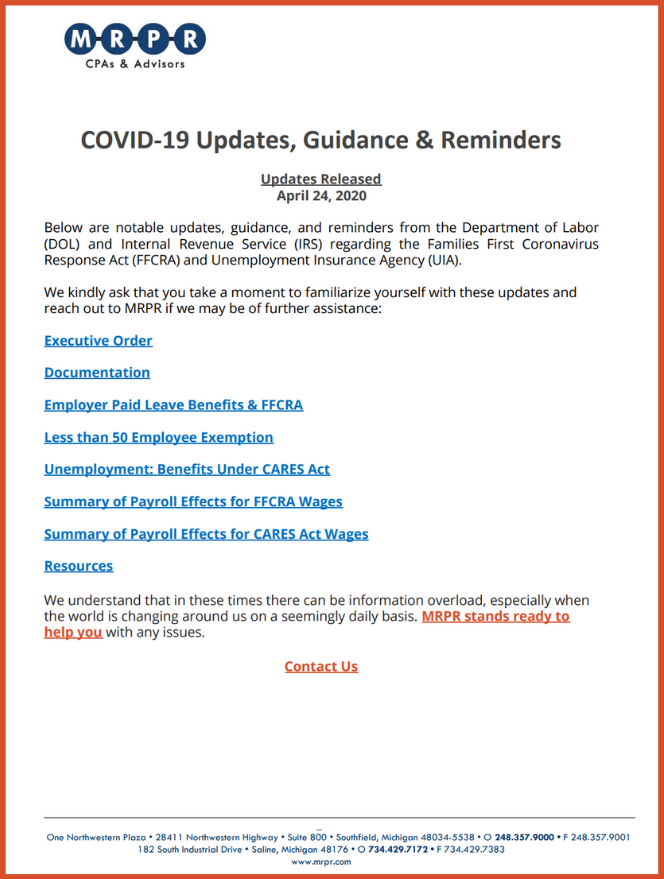

We have gathered the notable updates, guidance, and reminders from the Department of Labor (DOL) and Internal Revenue Service (IRS) regarding the Families First Coronavirus Response Act (FFCRA) and Unemployment Insurance Agency (UIA).

Topics: Tax Topics, COVID-19 Updates

The 'Qualified Improvement Property' Error Finally Corrected

The Tax Cuts and Jobs Act of 2017 (TCJA) was one of the most consequential tax law changes of the last three decades. However, when it was passed, it expanded and reworked the definition of “qualified improvement property". The new definition contained a critical error, which we will explore below. That error has just been corrected with the passage of the CARES Act of 2020. Since the correction is retroactive, the IRS has released new information and new guidance for taxpayers to address these new changes. Here's what you need to know.

Topics: Tax Topics, COVID-19 Updates

Top 10 Questions About The Paycheck Protection Program

An important provision of the CARES Act, the Paycheck Protection Program (PPP) received an additional $310 billion in funding from Congress on April 24, 2020, after running out of the $349 billion in funds in the initial tranche. With a massive $659 billion in total funding, the program offers loans that have the possibility of being completely forgivable, if spent in the way the government has mandated.

Topics: Tax Topics, COVID-19 Updates